How much is public and product liability insurance?

In this video, part of our Public Liability FAQ series, we answer the question ‘How much is public and product liability insurance?’.

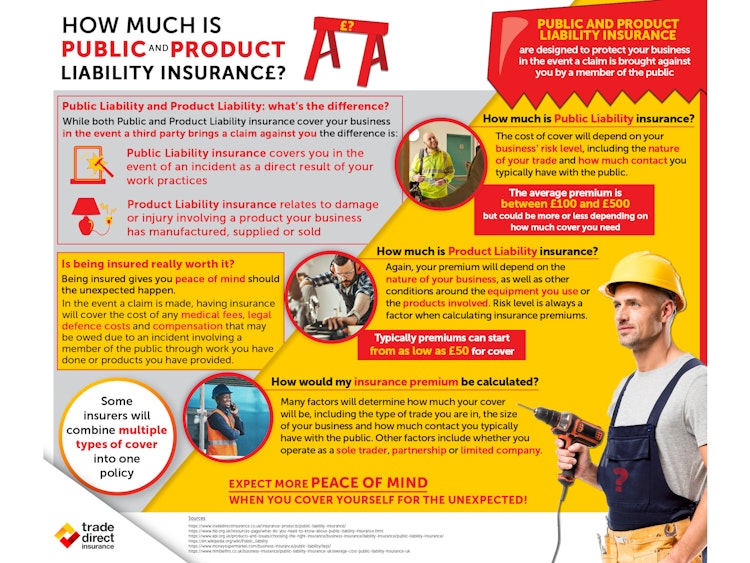

What’s the difference between public liability and product liability?

They both cover third-party claims for injury or damage to property, but public liability insurance covers claims that occur as a result of the way you deliver your services or something you have done.

Product liability insurance relates to a claim for damage or injury caused by a product you have manufactured, supplied, or sold.

How much is public liability insurance?

Premiums can be as little as £60 for some small businesses and sole traders, but generally range somewhere between £100 and £500.

How is public liability insurance calculated?

The cost will depend on several factors, including your trade and the size of your business.

Generally, the cost will be lower for a carpenter than it will be for a builder, as the risk of injury or damage is lower. Businesses deemed to pose a higher risk, or which use dangerous equipment, will usually have to pay more.

Other factors that may be considered include your turnover, and whether customers, clients, or members of the public come to your premises.

The amount of cover you need will also influence your premium.

How much is product liability insurance?

Again, it will depend on the size and nature of your business, how risky your trade is, the equipment you use, and the amount of cover you choose. For some trades it can be as little as £50.

Must I have two separate policies?

Although you may need both types of insurance, you can normally buy both as part of a combined package of insurance.

Is insurance worth the price?

When you consider the potential cost of a personal injury claim, then being insured is definitely worth it. If your business were to cause an injury, you could be ordered to pay many thousands of pounds, in addition to legal fees.

With a policy in place, you will enjoy peace of mind. In the event of a claim, your business will be protected.

In addition, you will be spared the complication, time, and expense of dealing with your case. A lawyer will be appointed in your place to handle the particulars.