Do sole traders need public liability insurance?

What is public liability insurance?

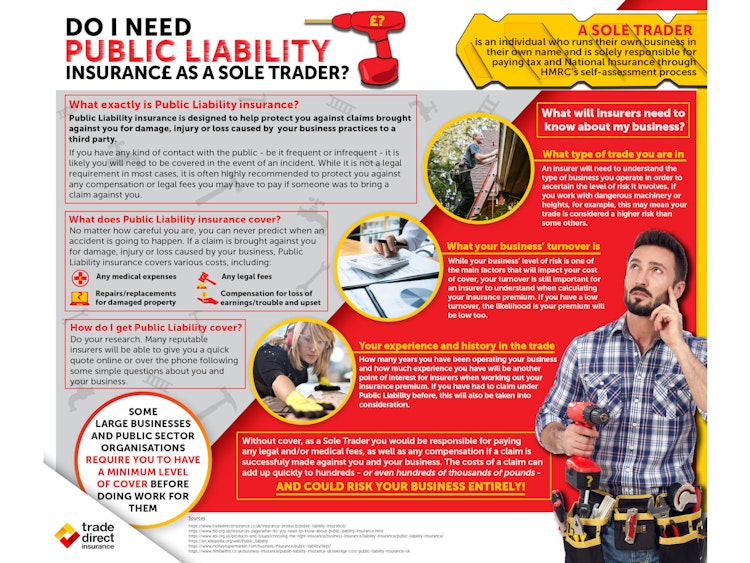

If something happens when you’re working and, as a result, someone is injured or damage is caused, public liability insurance will protect you against any subsequent claims for compensation brought against you. It will also cover associated legal fees.

In this video, part of our Public Liability FAQ series, we answer the question ‘Do sole traders need public liability insurance?’.

Am I legally classified as a sole trader?

You are a sole trader if you are running a business in your own name and are responsible for paying tax and National Insurance yourself. If you operate by way of a private limited company, or you are classified as a worker or employee, you are not a sole trader.

If there is no legal distinction between you and your business, and you collect all the income yourself and then pay tax and National Insurance by way of HMRC’s self-assessment process, you are a sole trader.

Who needs public liability insurance?

Public liability insurance provides protection for anyone whose business and work brings them into contact with the public. Contact with the public can be frequent (i.e. throughout every working day) or infrequent.

There is no legal requirement to have public liability insurance, but as it’s impossible to predict when an accident may happen, we strongly recommend you get insurance.

Bear in mind: some large businesses and some public sector organisations will require you to have public liability insurance before they will work with you.

Do I still need public liability insurance if I have a low turnover?

Yes. The need for public liability insurance is not determined by your turnover; it depends on whether you come into contact with the public. However, many insurance providers will consider your turnover when calculating your insurance premium.

If you have a low turnover, your premium is likely to be lower. For most sole traders, the premium is often less than £1,000.

Another factor that may affect your premium is the nature of the work you do. The higher the risk of accident or injury, the higher the premium may be.

Is it really worth it?

If a claim is brought against you as a sole trader and you do not have insurance to protect you, you will have to pay any successful claim for damages and compensation. Even with the smallest of accidents, damages can add up to thousands or hundreds of thousands of pounds.

Claims that may be brought against you include medical costs, replacement of items, loss of earnings and much more. If you must pay these yourself, not only could it put your business at risk, your home, savings, and other assets could be on the line if you are unable to meet the demands out of your business’ profits.

How do I get public liability insurance?

Choose a reputable insurance company and contact them.

On our website, for example, you can either complete the online form or call us.