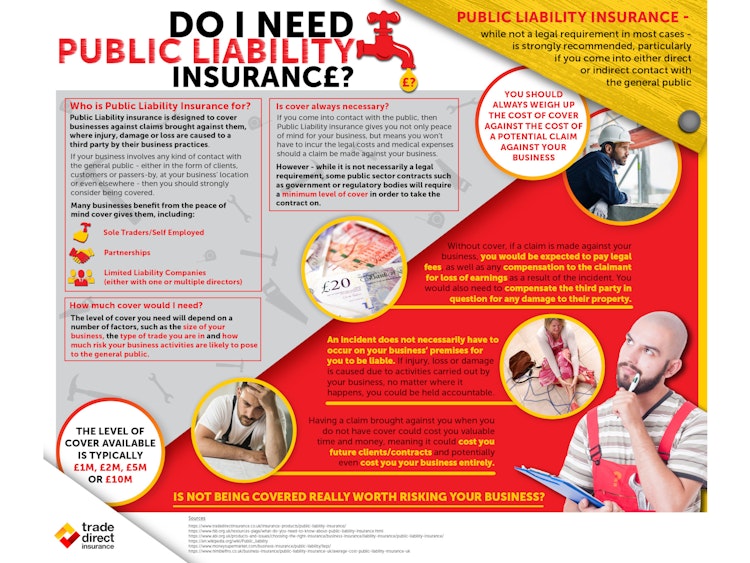

Do I need public liability insurance?

It’s a good question that we get asked often. So, once again, in this post, we’ve answered the most commonly asked questions, to help you decided whether or not you need Public Liability cover.

In this video, part of our Public Liability FAQ series, we answer the question ‘Do I need public liability insurance?’.

Is Public Liability Insurance for individuals or businesses?

Public Liability Insurance is for businesses that come into contact with the public either on your business premises (such as shop), at their premises (at a client’s house) or even out and about in public.

It covers claims for damage or injury caused as a result of something you or your business has done, for example, when a customer trips on a crate that has accidently been left in the aisle of a shop or slips on a wet floor that should have had a warning sign. These sorts of incidents are quite common and the amount of damages that can be claimed can really add up. Therefore, Public Liability Insurance is important protection because otherwise you would have to pay for the claim yourself or out of your business and that can be financially crippling.

Typical types of business who should have Public Liability Insurance include:

- Tradesmen including carpenters, electricians, builders, plumbers, etc.

- Shops, restaurants, hairdressers, tattoo studios

- Professional services where the public come into the office such as lawyers or accountants

- Gardeners, professional cleaners, dry cleaning services, etc.

However, this is not an exhaustive list, and more or less anyone who comes into contact with the public in the course of their work should consider taking out insurance. Even if clients come to your home, you should still consider it.

I am a sole trader / self employed, do I need Public Liability Insurance?

The fact that you are a sole trader rather than a limited company doesn’t determine whether you need Public Liability Insurance. It’s a question of whether or not you come into contact with the public.

That said, the fact that you’re a sole trader means you may have a lower turnover than a limited company, and smaller contracts. If so, you may find that your premiums are slightly lower as a result.

I don’t earn much, do I still need it?

If you come into contact with the public, then you need Public Liability Insurance however modest your earnings may be. The same is true even if you only ever contract with other small businesses or individuals.

Some of my larger contracts insist I have Public Liability Insurance, is that legal?

Yes, it is common practice for larger organisations to insist their suppliers have Public Liability Insurance, particularly in the construction industry, and there may also be a requirement that your Public Liability Insurance provides a minimum amount of cover of £5million. Whilst these businesses can’t force you to take out cover, they can refuse to do business with you if you don’t.

What about public sector contracts?

Government and local authority contracts will normally insist you have Public Liability Insurance cover of at least £5 million, and if you cannot prove you have cover, you won’t get the contract.

Can my trade association insist I have cover?

Yes and no. Although nobody can force you to take out cover, if having Public Liability Insurance is one of the terms and conditions of membership of your trade association, then they can refuse you membership if you don’t comply.

Is it a legal requirement to have Public Liability Insurance?

No, it’s not a legal requirement and you can’t be fined for not having it. However, you may lose out on bigger projects if you don’t have suitable insurance and more importantly, you may be putting your business at risk, if someone brings a claim against you which you can’t pay because you don’t have cover.

Is it worth the money?

You may not think it’s worth it until you have a claim brought against you. But if you’re faced with a claim for thousands or hundreds of thousands of pounds, then suddenly you’re premium is going to feel very worthwhile and could save your business. Having Public Liability Insurance also provides peace of mind, so yes, if you ask us, it’s worth every penny.