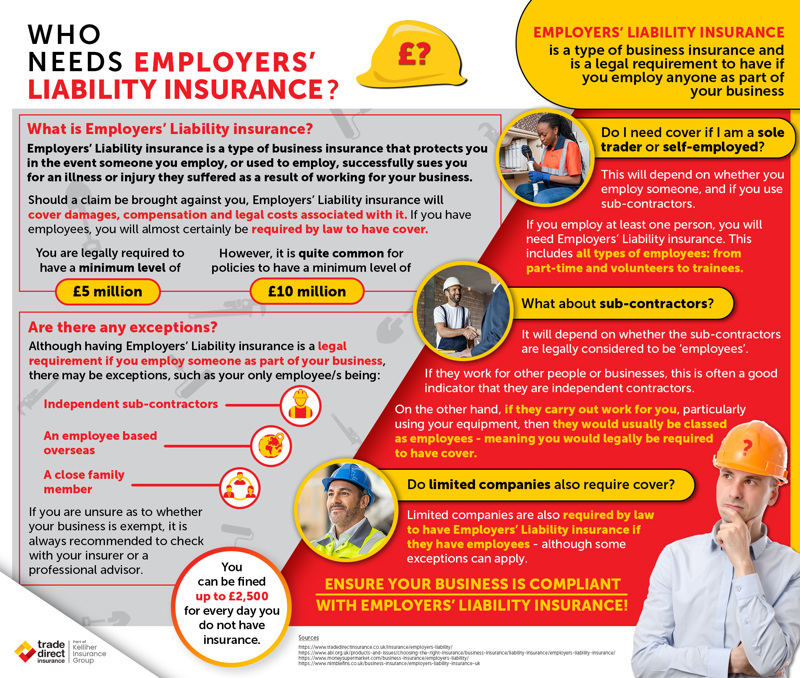

Who needs employers’ liability insurance?

What is employers’ liability insurance?

It’s a form of business insurance that protects you in the event someone you employ, or used to employ, successfully sues you for an illness or injury they suffered as a result of working for your business.

Employers’ insurance will pay the damages, compensation, and legal costs associated with such a claim.

If I am a sole trader or self-employed, must I have it?

This will depend on whether you employ someone, and if you use sub-contractors.

If you employ at least one person, you will need employers’ liability insurance. This includes all types of employees: from part-time and volunteers to trainees.

Are there any exceptions?

If you employ a close family member, or if the person you employ lives overseas, insurance may not be needed. However, it is recommended that you check.

What about sub-contractors?

It will depend on whether the sub-contractors are legally considered to be ‘employees’. Whether this is the case comes down to how much they just do the work you tell them to do, using your equipment, or whether they are more independent.

If they work for other people or businesses, this is often a good indicator that they are independent contractors. If you are in any doubt, check with a professional authority such as an insurance company, accountant, or lawyer.

If your sub-contractors are, in fact, employees, you will legally be required to have employers’ liability insurance.

Do limited companies need cover?

Limited companies are also required to have employers’ liability insurance if they have employees.

There are a couple of exceptional circumstances, e.g. if an employee is a close family member or is based overseas.

However, this is not always straightforward. Check with your insurance company or a professional advisor if you have any doubts.

How much cover is required?

You are legally required to have a minimum of £5 million of cover. However, it is common for standard policies to provide cover up to £10 million.

You can be fined up to £2,500 for every day you don’t have insurance. You can also be fined £1,000 for failing to display your employers’ liability certificate, or if you fail to show it to an inspector on request.