The cost of cutting back on tradesperson insurance

05 September 2023Cutting back on insurance can expose tradespeople to the cost of work-related accidents at a time when few can afford any unexpected costs. A recent survey found that almost a quarter (22%) of trades opted to remove some insurance cover, and 15% reduced the level of insurance protection for their business.

The Financial Conduct Authority (FCA) survey also reports that over six million people across the UK cut or cancelled insurance over six months up to January 2023. The regulator believes the cost-of-living crisis is driving individuals and businesses to try and save money.

Protect against the risks of underinsurance

Injuries and accidental damage on the job can outweigh the cost of a tradesperson’s annual insurance premium. Yet, continued high inflation means many personally take on the financial risk of underinsuring.

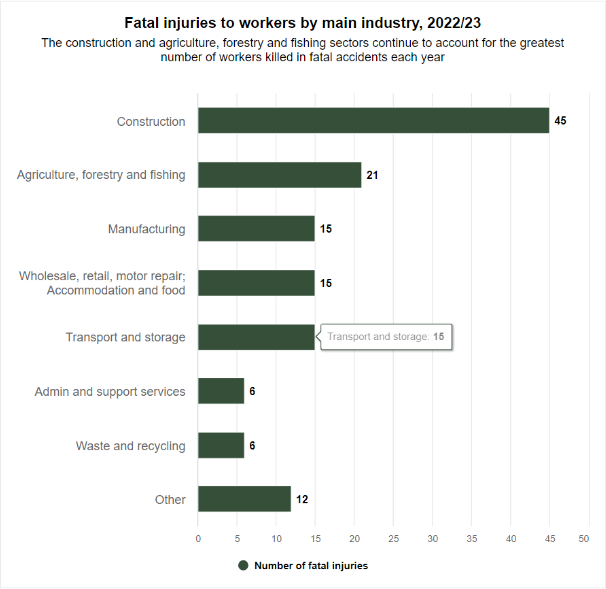

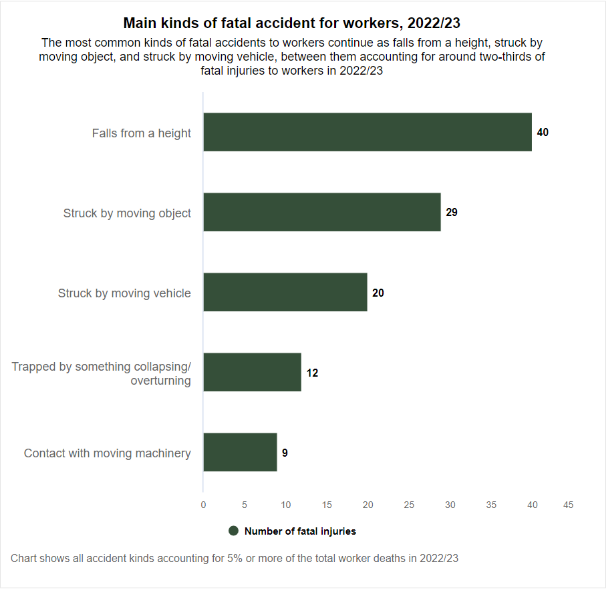

The Health & Safety Executive’s (HSE) figures show that construction workers experience the most injuries, so cutting back on insurance can be riskier for tradesmen and tradeswomen. Falling from height continues to be the most common fatal accident, closely followed by being struck by a moving object. Slips, trips, and falls on the same level accounted for almost half (48%) of all non-fatal employee injuries. The HSE says that slips, trips or falls on the same storey were the most reported non-fatal accident across all industry sectors in 2021/22.

Why do tradespeople need insurance?

Taking time to prioritise expenditure for public liability insurance and tools insurance can protect against the cost of accidents and tool theft. It means not having to stop or delay work and covers unexpected incidents. If a member of the public is accidentally injured on your work site, it could result in a large personal injury compensation claim. Public liability insurance covers such claims and damage caused by things like paint spills, damaged woodwork and walls, or electrical items and fittings. Employers’ Liability insurance covers accidents or injuries to employees (including apprentices) and is required by law.

Professional indemnity insurance covers if a customer claims the designs or advice, they were given was negligent. No one sets out to make mistakes, but the reality is that they do happen, particularly on more complex work, where there is a greater chance of things going wrong. Professional indemnity insurance covers negligence claims against tradespeople which can save a lot of money and worry.

Metropolitan Police data reveals that tool theft from a vehicle increased by 25% in the past year across London alone. Police data showed tradespeople are 10 times more likely to experience tool theft from a vehicle than they are from a building site or their place of work. With just 14% of cases leading to the suspect being identified, the chances of recovering stolen tools are rare.

Tools insurance protects portable powered and non-powered hand-held devices against loss or damage both in the vehicle and on-site. Cover can range from £1,000 to £15,000, and tools are also protected in the European Union.

Get an online quote or call Trade Direct Insurance for tradesperson insurance on 0800 0318 497 for a quote today.

Trade Direct is authorised and regulated by the Financial Conduct Authority. The company is a leading UK independent broker providing a wide range of policies to tradesmen and construction workers.

This note is not intended to give legal or financial advice, and, accordingly, it should not be relied upon for such or regarded as a comprehensive statement of the law and/or market practice in this area. In preparing this note we have relied on information sourced from third parties and we make no claims as to the completeness or accuracy of the information contained herein. You should not act upon information in this bulletin nor determine not to act, without first seeking specific legal and/or specialist advice. We and our officers, employees or agents shall not be responsible for any loss whatsoever arising from the recipient’s reliance upon any information we provide herein and exclude liability for the content to fullest extent permitted by law.