Bank Rate Cut from 4.25% to 4.0% – What It Means for SMEs and Tradespeople

08 August 2025Posted by:

Patricia Gardiner

Sales and Marketing Director, Trade Direct Insurance

The Bank of England has lowered its main interest rate from 4.25% down to 4%, which is first time the base rate has been as low as 4% since 2023. This could be a relief for small businesses and tradespeople in the UK who have faced two tough years of high loan costs and tight money.

This report examines what a rate cut would mean for credit, investment appetite, and the everyday business reality for SMEs (Small and Medium Sized Enterprise).

Source

The Economy and How Loans Are Given

The context:

Inflation at 3.4% (May 2025), and ongoing global volatility have kept monetary policy “restrictive”.

Household and SME sentiment:

Household consumption is barely growing (+0.2%), and SME confidence is very low - just 20% are “very confident” in a positive 12-month business outlook.

Lending in 2024–25:

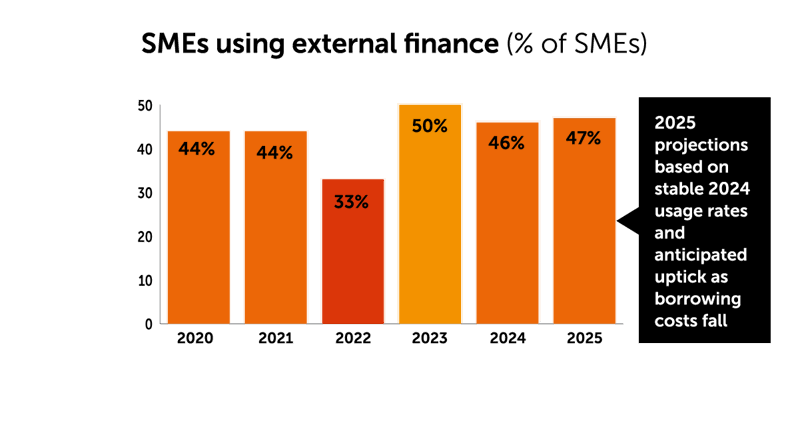

Bank lending to SMEs was £62bn in 2024 (+4.5% YoY), outpacing asset finance for the first time since 2020. The biggest growth was among the smallest businesses (+30% YoY in Q1 2025), but the use of external finance has dropped from 50% to 43% over the last year.

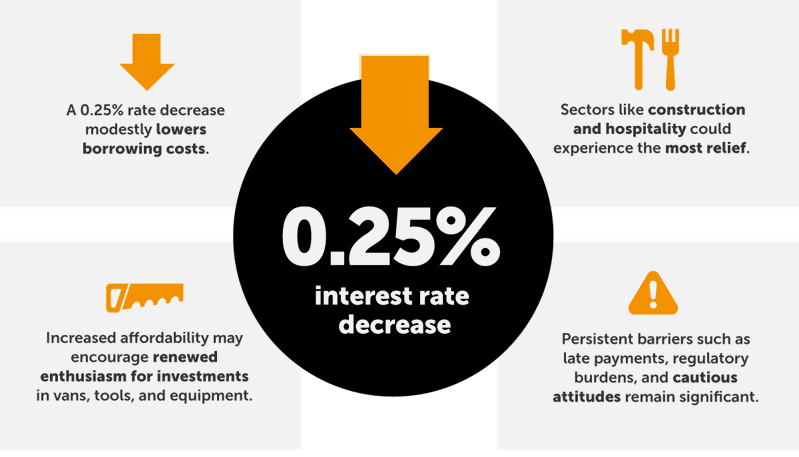

What a 0.25% Rate Cut Could Mean

Borrowing Costs and Demand

A 0.25% drop would cut average new SME loan rates from the historic high of 7.65% closer to 7.4%.

For small businesses with loans that have changing interest rates, or those thinking about getting new loans, this means their monthly payments will reduce, which can help with monthly expenses.

Some business owners who delayed purchasing equipment, vans, or tools due to high borrowing costs could now reconsider, especially with optimism that rates may continue to decrease.

Confidence and Investment Appetite

A rate cut signals a turning point and may modestly improve sentiment—especially among “on-the-fence” SMEs and those growing fastest.

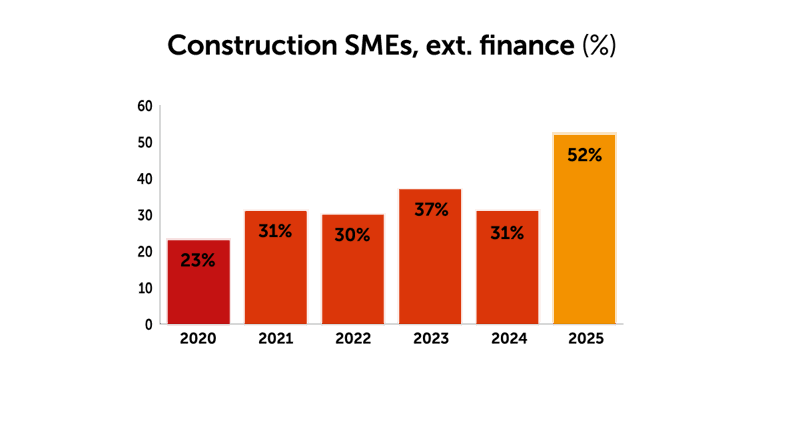

Some industries, like construction and hospitality, have more businesses that are struggling to pay bills and make a good profit.

These industries might benefit the most from the small drop in interest rates. But most small businesses (about 70 out of 100) still don’t want to borrow money because they worry about debt, even if that means their business grows more slowly. So, most will still be careful and avoid taking loans.

Approval and Accessibility

- Approval rates for new credit (currently 56%, below pre-pandemic 74%) may edge up as lenders see slightly improved affordability for borrowers.

- Challenger and specialist banks (now 60% of SME lending) may intensify competition, offering even keener deals than large high street banks.

Ongoing Barriers and Risks

However, a small rate cut does not solve embedded issues:

- High late payment rates (affecting 69% of SMEs), regulatory burdens, and wide gaps in awareness of finance options (60% of non-borrowers are unaware of what’s available).

- Most of the money businesses receive from loans is used to pay daily expenses and keep the business running, not investing in growth.

Expected Effects of a Rate Cut to 4%

In the following scenarios, these are the expected effects:

- Interest cost reduction

Lower monthly payments; modest boost to affordability. - Improved sentiment

More SMEs consider borrowing, but overall demand rises only slightly. - More accessible finance

Approval rates may climb a few points, especially with challenger Banks. - Purchases/equipment upgrades

Those who have delayed capital expenditure may move ahead

Key Takeaways for SMEs and Trade Businesses

- A rate cut to 4% would deliver immediate, if limited, breathing room for SMEs under financing pressure, with the biggest relative gains for those poised to invest or expand.

- Media and business audiences should watch for small signs of renewed capital spending, but shouldn’t expect a surge - for most, confidence and external challenges continue to overshadow a slight fall in interest rates.

This monetary loosening may mark the start of a gentle turning point, not an overnight transformation.

Why Insurance Still Matters, Even When the Interest Rate is Down

A rate cut may help your monthly budgeting and create optimism, but the need for strong business insurance does not go away. Risks like theft, accidents, legal problems, or unexpected shutdowns can strike regardless of interest rates.

If Insurance is cut, one serious incident could wipe out hard-won financial gains.

- Regularly review your insurance with a specialist to make sure your coverage matches your current needs and asset values - even when the outlook brightens.

- The best time to prepare for tough times is when things are starting to improve, so robust insurance remains a must, not a nice-to-have.

Patricia Gardiner, Sales and Marketing Director at Trade Direct Insurance, commented:

"The Bank of England’s interest rate cut is a welcome development for SMEs and tradespeople, offering a glimmer of relief amid ongoing economic uncertainty. However, it's only the beginning. Many businesses remain cautious about investing, with concerns around late payments, cash flow, and limited awareness of available financial support. As confidence gradually returns, it’s worth remembering that having the right protections in place—such as insurance—can help businesses navigate the ups and downs and stay resilient as conditions evolve."

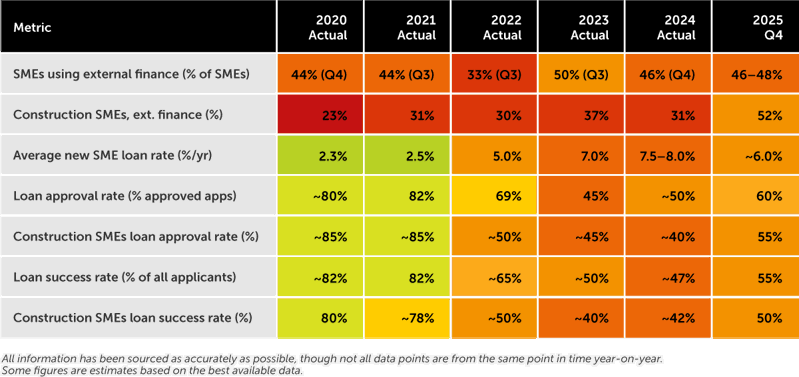

Here is a more detailed comparison of the changes over a longer period

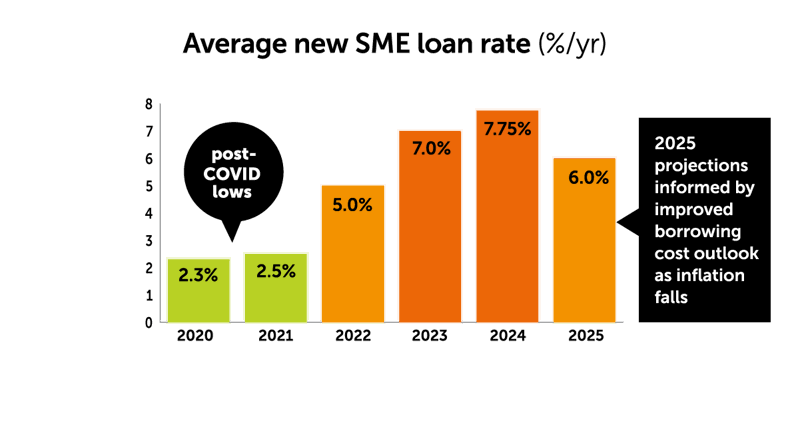

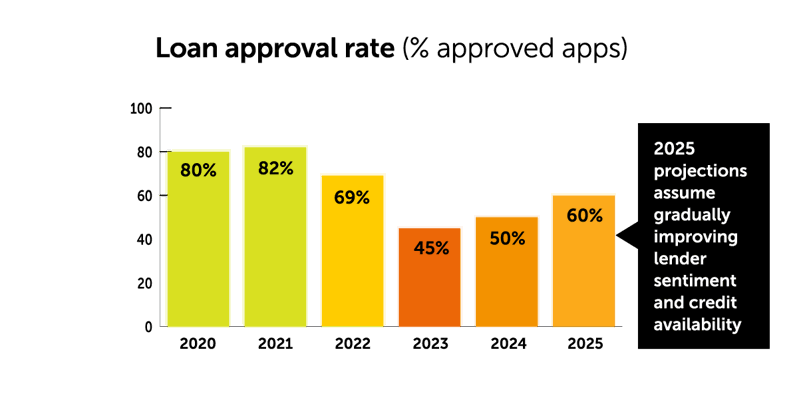

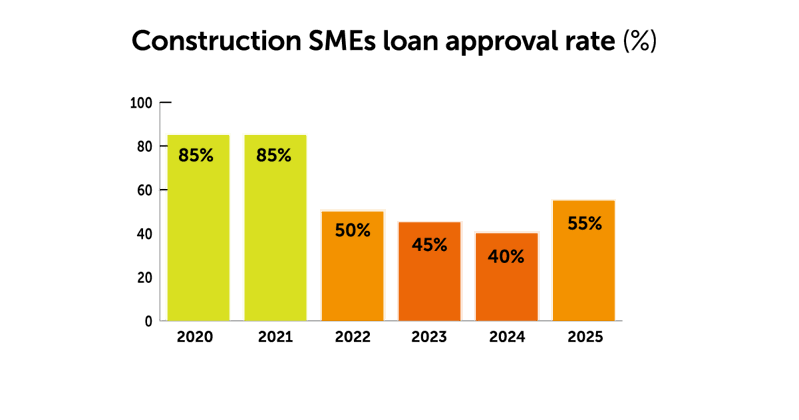

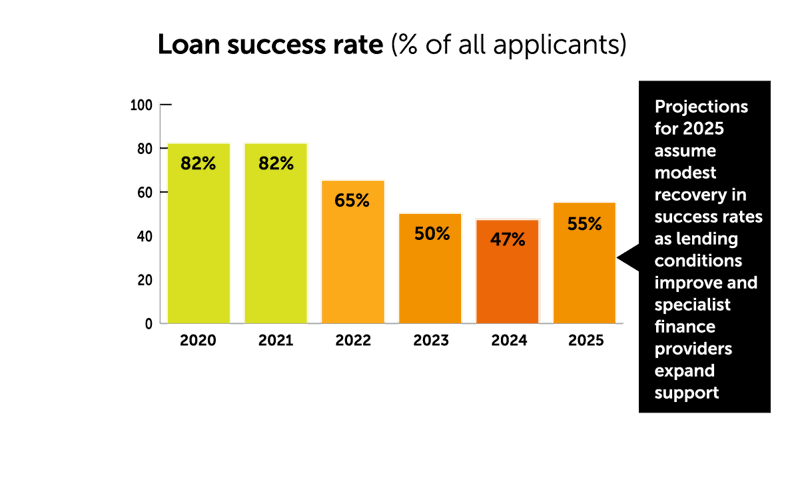

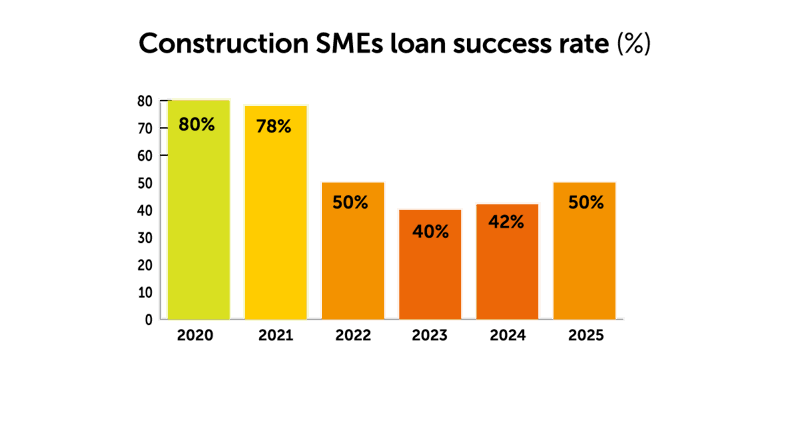

Interest rates on new SME loans rose from historic lows of ~1.6% in 2020 to 7.6% at the 2024 peak. Loan approval and success rates, historically 80%+, fell below 50% post-pandemic, but are projected to recover gradually with easing borrowing costs in late 2025. Construction SMEs have seen sharper swings, especially in finance usage and success rates, reflecting greater sector risk and higher capital needs.

Data Sources

- https://doc.ukdataservice.ac.uk/doc/6888/mrdoc/pdf/6888_bvabdrc_sme_fm_q4_2024_report.pdf

- https://www.british-business-bank.co.uk/sites/g/files/sovrnj166/files/2025-02/small-business-finance-market-report-2025.pdf

- https://www.british-business-bank.co.uk/about/research-and-publications/small-business-finance-markets-report-2024/factsheet

- https://www.ukfinance.org.uk/news-and-insight/press-release/gross-lending-smes-in-2024

- https://www.gov.uk/government/calls-for-evidence/small-business-access-to-finance/small-business-access-to-finance

- https://www.global-rates.com/en/interest-rates/central-banks/1003/british-boe-official-bank-rate/

What does the above data table mean?

Over the past six years, UK SMEs have navigated an extraordinarily volatile environment in terms of credit demand, loan costs, and access to finance:

Pandemic Support and Recovery:

In 2020 - 2021, government-backed lending schemes drove SME usage of external finance to record highs (43 - 44%), with historically low interest rates (~2.3 - 2.5%) and exceptionally high loan approval/success rates (80%+). This period offered unprecedented credit availability and affordability for small firms.

Withdrawal of Support and Rising Rates:

As pandemic schemes ended in 2022, usage of external finance dropped (down to 33 - 40%), while average SME loan rates more than doubled to around 5 - 6%. Approval and success rates fell sharply (approval ~60%, success ~56%), reflecting stricter lending criteria and growing economic uncertainty.

Cost Pressures and Tight Credit (2023 - 2024):

By mid-2023, SMEs faced the tightest credit environment of the decade. Use of external finance rebounded somewhat (peaking at 50%), but the average new SME loan rate surged to 7.4 - 8.0%. Loan approval and success rates dropped to historical lows (approval and success 45%+) especially impacting riskier sectors like construction. Businesses became markedly more risk-averse, and margins were squeezed by high borrowing and input cost.

2025 Outlook - Modest Improvement as Rates Ease:

As of early 2025, rates have started to edge down (~7.0%), with projections for further easing to ~6.0% by year-end if Bank Rate cuts are delivered. Use of external finance is expected to rise modestly for SMEs (46 - 48% overall), while projections suggest loan approval rates could recover to 60%, and loan success rates to ~55%.

Sources

- https://www.british-business-bank.co.uk/about-research-and-publications/small-business-equity-tracker-2025

- https://www.ukfinance.org.uk/news-and-insight/press-release/increased-sme-lending-high-street-banks

- https://www.cliftonpf.co.uk/blog/28082024114800-sme-finance/

- https://www.ukfinance.org.uk/system/files/2025-05/UK%20Finance%20response%20to%20HMT%20and%20DBT%20Call%20for%20Evidence%20Access%20to%20Finance.pd

- fhttps://www.british-business-bank.co.uk/news-and-events/news/challenger-and-specialist-bank-lending-hits-record-high-overall-proportion-smaller-businesses

- https://www.british-business-bank.co.uk/about/research-and-publications/small-business-finance-markets-report-2025

- https://www.british-business-bank.co.uk/about/research-and-publications/small-business-finance-markets-report-2025/factsheet

- https://www.british-business-bank.co.uk/sites/g/files/sovrnj166/files/2025-02/small-business-finance-market-report-2025.pdf

- https://www.british-business-bank.co.uk/about/research-and-publications/markets-spotlight-november-2024-small-business-finance-markets

- https://www.bva-bdrc.com/wp-content/uploads/2025/03/SME-FM-FULL-REPORT.pdf

- https://www.bva-bdrc.com/sme-finance-monitor/

- https://www.bva-bdrc.com/wp-content/uploads/2025/05/SME-Monthly-charts-March-2025-v1a.pdf

- https://www.bva-bdrc.com/wp-content/uploads/2025/03/SME-FM-CHAPTER-SUMMARIES.pdf

- https://www.bva-bdrc.com/wp-content/uploads/2025/03/SME-FM-MANAGEMENT-SUMMARY.pdf

- https://www.british-business-bank.co.uk/about/research-and-publications/small-business-finance-markets-report-2025

- https://www.ukfinance.org.uk/system/files/2025-06/Business%20Finance%20Review%202025%20Q1.pdf

- https://www.ukfinance.org.uk/data-and-research/data/business-finance-review

- https://www.ukfinance.org.uk/news-and-insight/press-release/increased-sme-lending-high-street-banks

- https://www.ukfinance.org.uk/system/files/2024-12/Data%20Release%20Calendar%202025.pdf

- https://www.bankofengland.co.uk/prudential-regulation/publication/2025/may/sme-and-infrastructure-lending-adjustments

- https://www.ukfinance.org.uk/our-expertise/data-analysis

- https://www.british-business-bank.co.uk/sites/g/files/sovrnj166/files/2025-02/small-business-finance-market-report-2025.pdf

- https://www.bankofengland.co.uk/statistics/money-and-credit/2025/april-2025

- https://thefintechtimes.com/uk-smes-are-missing-out-on-thousands-in-interest-due-to-uncompetitive-bank-rates/

About the author

Patricia Gardiner

Sales and Marketing Director, Trade Direct Insurance

Connect with Patricia >

Read Patricia's profile >

Patricia is a seasoned marketing and sales leader with nearly 25 years of global experience with the last 6 years in the insurance and financial services sectors. As Sales and Marketing Director at Trade Direct Insurance, Patricia leads the strategic direction of the company’s customer acquisition, retention, and brand development.